when will capital gains tax increase uk

The capital gains tax in Croatia equals 10. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on.

Difference Between Income Tax And Capital Gains Tax Difference Between

25 March 2021.

. The Revenue received 143 billion in CGT for the 2020-21 financial year representing a 42 per cent increase from the previous period. Temporary increase to Stamp Duty Land Tax nil rate band for residential properties. The tax-free allowance is currently 12300 per person in 2021-2022 the same as it was in 2020-2021 or 12000 in 2019-20.

For long-term capital gains indexation benefit could be availed to increase the cost on account of inflation. Just as a reminder you will be considered a tax resident in Spain if you stay in the country for more than 183 days per year 6 months. No capital gains tax.

This measure is about disposals of interest in non-residential UK property and changes to payments on account for Capital Gains Tax to within 30 days of the sale or disposal of a residential property. First deduct the Capital Gains tax-free allowance from your taxable gain. Capital Gains Tax for Spanish residents.

Capital Gains Tax on the gains of trustees. The first thing you need to know about capital gains tax is that they come in two flavors. In addition to federal taxes on capital gains most states levy income taxes that apply to capital gains.

Therefore the tax saving to a CGT paying individual looking to realise this investment would be up to 28000. Assuming no other tax reliefs your CGT bill on this transaction would be 6786 if youre a basic-rate taxpayer or 10556 if youre a higher-rate taxpayer. Capital Gains Tax and Corporation Tax on UK property gains.

In that sense if you considered a resident the capital gains tax to be paid will. Your short-term capital gains are taxed at the same rate as your marginal tax rate tax bracket. It was introduced in 2015 with 12 and reduced to 10 in 2021.

There is currently a bill that if passed would increase the capital gains tax in Hawaii to 1100 and would also increase the states income tax. Obviously if the gold price continued to increase and the investor chose to hold on to their gold the tax savings could be even greater. Be liable to Capital Gains Tax.

New figures show that the amount of Capital Gains Tax raked in by HM Revenue Customs has skyrocketed. Add this to your taxable income. The Capital gains summary form and notes have been added for tax year 2020 to 2021.

At the state level income taxes on capital gains vary from 0 percent to 133 percent. The long-term capital gains tax rate is 0 15 or 20. Capital gains tax rates for 2022-23 and 2021-22.

I was unsure when it referred in Article 135 to GAINS RELATING TO PROPERTY and what comes under the definition of property. The tax-free allowance for trusts is. Capital Gains Tax CGT is imposed at the rate of 20 on.

However they spent 5000 on. The 0 bracket for long-term capital gains is close to the current 10 and 12 tax brackets for ordinary income while the 15 rate for gains corresponds somewhat to the 22 to 35 bracket levels. Taxability as business income.

You can get an idea from the IRS of what your tax bracket might for 2021 or 2022. Since 6 April 2006 it has been possible if certain conditions are met to elect irrevocably for both Income Tax and Capital Gains Tax purposes but not only one of these taxes that a separate. More information can be found at Report and pay Capital Gains Tax on UK property.

Their capital gain is the increase in the property value which is 100000. Long-term capital gains tax is a tax applied to assets held for more than a year. Else they could be classified as short-term capital gains subject to tax at the applicable personal taxation rates.

The long-term capital gains tax rates are 0 percent 15 percent and 20 percent depending on your income. This means long-term capital gains in the United States can face up to a top marginal rate of 371 percent. If you sell a property in the UK you might need to pay capital gains tax CGT on the profits you make.

The general capital gains tax rate in Colombia is 10 with the exception of lottery or gambling winnings which are taxed at 20. Long-term capital gains tax is a tax on profits from the sale of an asset held for more than a year also known as a long term investment. Buy to let was cited as one of three reasons why the UKs CGT bills jumped 20 per cent from 108.

Trustees only have to pay Capital Gains Tax if the total taxable gain is above the trusts tax-free allowance called the Annual Exempt Amount. The good news is that capital gains are tax separately from other income so your income tax bracket for your other income will remain the same as it was. In Finland there is a tax of 255 or 272 on dividends 85 of dividend is taxable capital income and capital gain tax rate is 30 for capital gains lower than 30 000 and 34 for the part that exceeds 30 000.

Find out how much capital gains tax youll pay on property when you have to pay it and how lettings relief has changed. If cryptos are held as stock-in-trade then it could be taxed under the head business. You only have to pay capital gains tax CGT on gains that exceed your annual allowance.

22 May 2020 Helpsheets HS307 Non-resident Capital Gains for land and property in the UK and HS308 Investors. If you make a gain after selling a property youll pay 18 capital gains tax CGT as a basic-rate taxpayer or 28 if you pay a higher rate of tax. But on disposal they would only have to pay tax in UK because of double taxation agreement clause and would not have to pay tax in Australia.

Long-term capital gains tax on stocks. The gain will be the increase in value from 2. As a general rule the liability to tax on the gains accruing to the.

However effective tax rates are 455 or 472 for private person.

Difference Between Income Tax And Capital Gains Tax Difference Between

How High Are Capital Gains Taxes In Your State Tax Foundation

Canada Capital Gains Tax Calculator 2022

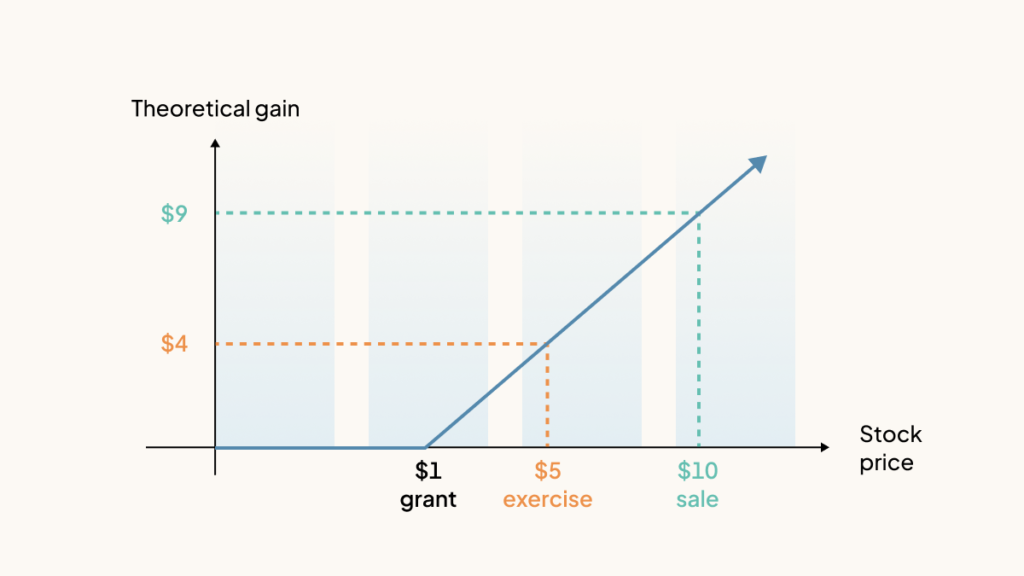

Calculating Taxable Gains On Share Trading In New Zealand

Capital Gains Tax Cgt Calculator For Australian Investors

Pin On Uk Property And Real Estate

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Capital Gains Losses From Selling Assets Reporting And Taxes

Capital Gains Yield Cgy Formula Calculation Example And Guide

Capital Gains Tax Cgt Calculator For Australian Investors

Capital Gains Tax What Is It When Do You Pay It

Capital Gains Tax On Gifts Low Incomes Tax Reform Group

Pin By Correctdesign On Menu Iphone App Samples Tax Table Capital Gains Tax Accounting

What Are Capital Gains Tax Rates In Uk Taxscouts

How Stock Options Are Taxed Carta

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

Uk Capital Gains Tax For Expats And Non Residents Expert Expat Advice